Designing a Deflationary Airdrop: Sonic's Innovative Approach to Token Distribution

This December, we’re excited to launch Sonic, a high-throughput layer-1 blockchain with its native token, S. To incentivize early adopters and loyal users, we’re planning a ~200 million S airdrop with a unique, inherently deflationary mechanism.

This deflationary mechanism not only rewards active participation but also gradually reduces the total supply of S tokens, potentially increasing their long-term value.

Deflationary Mechanism Explained

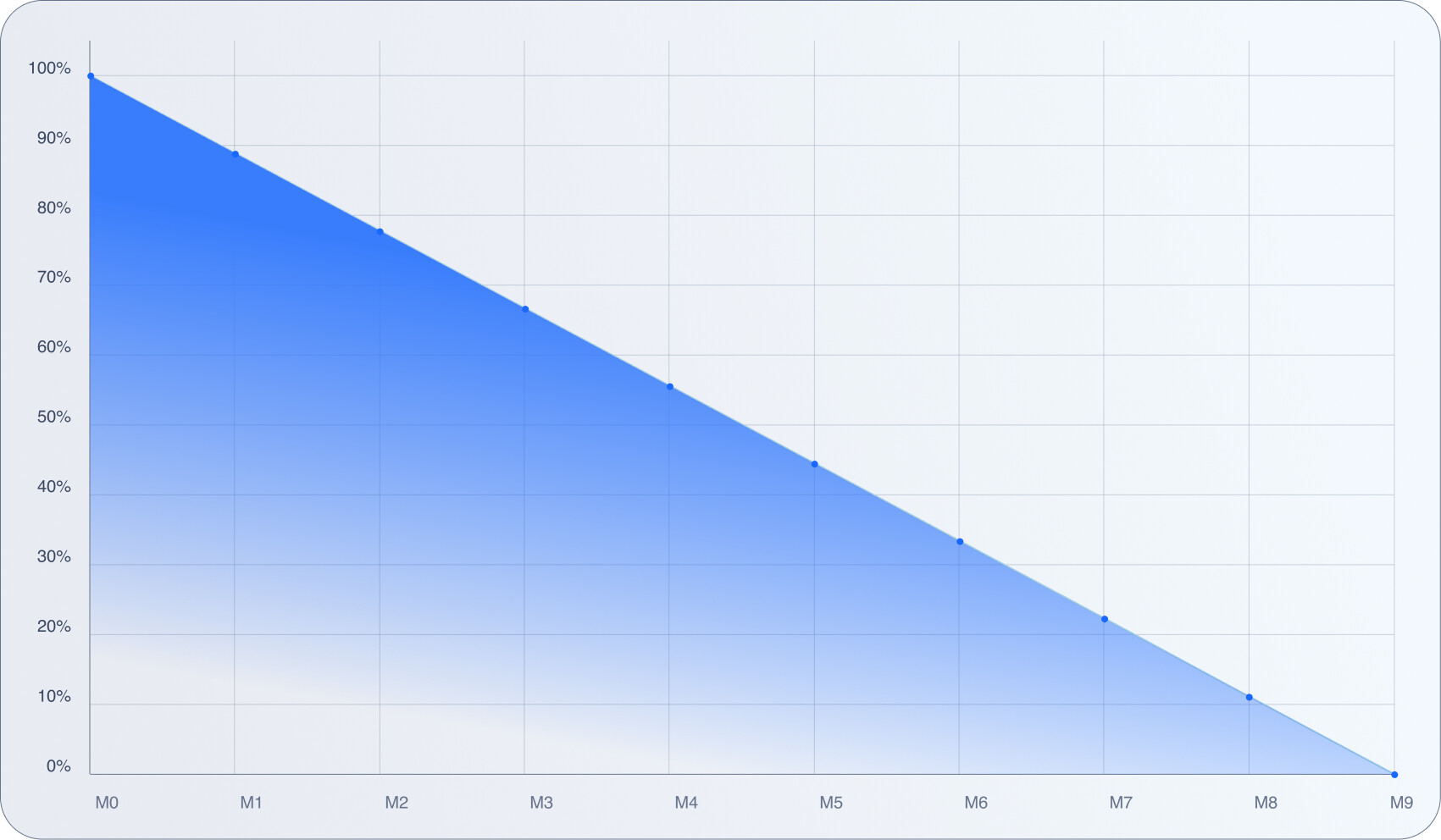

At the heart of this deflationary airdrop is a linear decay model that incorporates a token burn factor. Here's how it works:

As part of the initial distribution, recipients receive 25% of their allocated S tokens immediately upon the airdrop claim date. The remaining 75% is locked in a vesting schedule over 9 months in the form of ERC-1155 tokens (fungible NFTs).

If a user decides to claim their vested tokens before their full maturation period, a portion of these tokens is burned. The burn rate decreases linearly over the 9 months. The earlier the claim, the higher the percentage of tokens burned.

The chart below shows the number of vested tokens users would lose to the burn mechanism if they claim at different points within the 9 months.

By introducing a cost to users claiming their airdrop early, our burn mechanism encourages users to remain engaged with the Sonic network, potentially increasing on-chain activity and ecosystem growth.

Benefits of the Deflationary Airdrop

- Supply Reduction: As tokens are burned through early claims, the overall supply of S decreases, which can create token scarcity.

- Incentivized Holding: Users are motivated to hold their tokens until the vesting period ends to avoid burn penalties, promoting long-term investment and stability

- Active Engagement: The model encourages users to stay active within the network, as increased participation can maximize the utility of their tokens during the vesting period.

- Speculative Opportunities: The vested tokens are represented as ERC-1155 NFTs, which can be traded on secondary markets. This adds a layer of flexibility and speculative opportunity for users who wish to capitalize on market dynamics without triggering the burn mechanism.

Conclusion

Sonic's deflationary airdrop is a forward-thinking approach to token distribution. By integrating a linear decay and burn mechanism, we align the interests of the Sonic network and its users towards sustained growth.