FeeM Vault — The Next Evolution of Fee Monetization on Sonic

Fee Monetization (FeeM) on Sonic has seen remarkable success, with app-generated revenue approaching 1 million S across over 100 apps.

Today, we're taking it a step further by integrating the smart contracts of key tokens on Sonic (wS, USDC, USDT, EURC, WETH, and WBTC) into the FeeM program. 90% of the transaction fees generated by these contracts will be redirected into the FeeM Vault, owned and operated by Sonic Labs.

Funds in the FeeM Vault will be strategically deployed to strengthen the Sonic ecosystem, provide targeted support where apps need it most, and enhance asset incentives.

Learn more about this new innovation below.

What is Fee Monetization?

FeeM allows developers to earn 90% of the transaction fees their apps generate on Sonic. It’s a way to reward builders and creators based on real usage, similar to how platforms like YouTube pay creators for traffic. Learn more here.

Vision of the FeeM Vault

Until now, transaction fees generated by Sonic’s key token contracts — wS, USDC, USDT, EURC, WETH, and WBTC — were excluded from FeeM. This meant a stream of FeeM revenue generation activity couldn’t be reinvested back into the ecosystem. That changes today.

With the introduction of the FeeM Vault, 90% of the transaction fees from these high-impact tokens will now flow into a multisignature vault controlled by Sonic Labs.

Critically, the tokens that generate the revenue for the FeeM Vault will shape how it's spent. Apps that integrate and optimize for wS, USDC, USDT, EURC, WETH, and WBTC will be first in line to benefit. Key areas of deployment include:

- Liquidity Incentives – Directing FeeM Vault revenue toward strategic pools to deepen liquidity and reduce borrowing costs.

- Protocol Integrations – Funding integrations of core assets like USDC, WETH, and wS into apps.

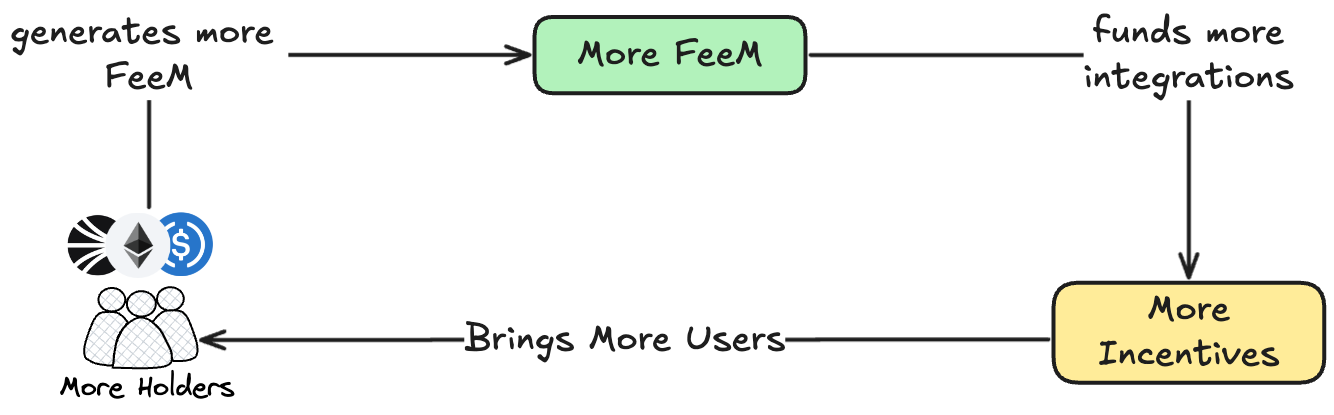

FeeM Vault Flywheel

The FeeM Vault is designed to compound growth across Sonic apps. As activity around key tokens increases, the Vault fills, and a self-reinforcing flywheel begins to spin:

- More usage of key tokens increases the transaction fees redirected to the FeeM Vault.

- More revenue in the FeeM Vault means more funding available for apps on Sonic.

- More funding for apps leads to more integrations and incentives involving key tokens, attracting more users.

- More users drive more activity and usage of those same tokens.

- And the cycle continues.

In DeFi, utility is everything. Tokens that are liquid, integrated, and actively used become the essential building blocks of a successful decentralized ecosystem.

Through the FeeM Vault, Sonic Labs is aligning incentives by redistributing transaction fees from core assets to users and protocols that drive activity of key tokens on the network.

By anchoring this system around assets like USDC, WETH, and wS, Sonic is building durable liquidity from the ground up. As usage expands, new assets may be added to reinforce the flywheel and deepen ecosystem value.