Sonic: Performance Under Pressure

On 10 October 2025, the biggest cryptocurrency market liquidation in history occurred. Many chains failed, slowed down, and demanded high fees.

In these events, we can observe that Blockchain tech is currently made for average load, but not peak load. Sonic Labs has always been focusing on peak load. A network must consistently perform at the same speed, regardless of load, to avoid stalled transactions and/or exorbitant transaction execution costs.

It's like ordering an Uber after a sporting event vs. ordering one from the same location during the day. During the day, rides are cheap and plentiful. But when it's game night and the game ends, everyone scrambles to get home at once, and the Uber drivers on the road raise their prices sky-high to meet demand. People end up paying luxury rates for a ride worth just a few bucks, not because the trip changed, but because the demand overloaded the system. At the end of the game, there is only a finite number of Uber drivers available, and the commodity of Uber cars becomes scarce.

The same happens with transactions on a blockchain during a market liquidation event. There are too many transactions issued, driven by positions that must be liquidated quickly. The block space/capacity becomes the available Ubers that are suddenly all booked.

Sonic mainnet did not experience any issues with provisioning sufficient transaction capacity.

We observed on many other networks that users struggled with many issues:

- The network is unable to provide sufficient speed to execute a time-sensitive transaction.

- The fees to execute a transaction jump exorbitantly to avoid overloading a congested network. Financially insignificant transactions become unviable. Suddenly, transaction costs exceed the transaction notional value. Why should a user pay $10 in gas for a transaction valued at $2?

- The likelihood of a failed transaction increases because a congested network cannot cope with the load and must drop transactions.

On other networks, the main issues for applications during peak load are:

- Liquidating money market positions so there is less chance of bad debt; and,

- Executing swaps on DEXs to retain and capitalize on trading fee volume and revenue generation;

Sonic fixes this.

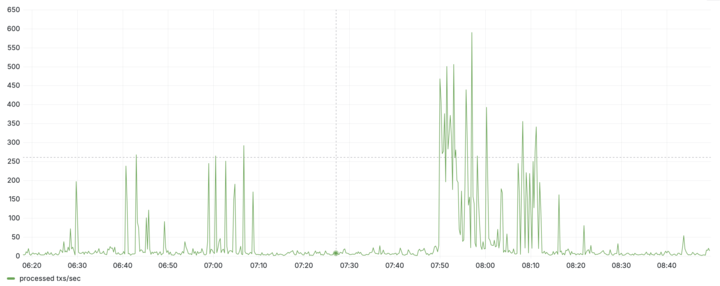

Performance and Throughput

The average load in the market liquidation event was manageable, with 6.89 transactions with a block emission rate of 0.58 seconds per block. However, the network had to process bursts of loads, such as block 50175760 with 1070 transactions. Over quarter-hour intervals, the network experienced loads that were two orders of magnitude higher than the average. We have been very pleased that the network provided sufficient elasticity for absorbing these workload spikes (averaged):

Gas Price Stability

Even at the event’s peak load of 624 million gas per second, the gas price held steady at this baseline. The protocol’s internal regulatory mechanisms did not trigger price adjustments, indicating the network’s capacity to handle volume without congestion. Sonic mainnet could have processed even higher volumes of data.

Interestingly, users voluntarily raised their tips substantially out of concern for inclusion delays. SonicScan data shows that average gas prices (including tips) were six times higher than normal on October 10, with one transaction tipping a remarkable 3,897,762 GWEI. These spikes reflected user behavior, not systemic inefficiency.

Ecosystem Impact

Thanks to our BD and Ecosystem team, we were able to connect with native builders and infrastructure providers on Sonic to get their feedback on how the event impacted their services (it didn’t).

Beets:

October 10th tested the network in extreme conditions. Around 95% of all volume that day cleared within fifteen minutes, yet pools finalized every trade as expected and fees scaled linearly with activity. It was a clear validation of Sonic’s throughput and Beets’ operational stability.

- Franz

Reference: https://dune.com/queries/6067103/9745356

Equalizer:

Equalizer's app remained fully operational thanks to multiple fallbacks, ensuring uptime while RPC issues appeared across the industry.

While Sonic kept working as intended, it is equally important for an app to stay operational in such times as some off-chain infra pieces may struggle. - Blake

Metro:

The October 10 flash crash was a true stress test for financial infrastructure. While many centralized exchanges halted trading entirely, Metropolis remained fully operational. Users continued swapping and even buying the dip through DLMM positions — all without interruption. The same was true for our Maker Vaults, where curators retained full control over position management. This resilience was only possible because Sonic continued producing blocks at lightning speed while maintaining exceptionally low gas fees throughout the event.

- Hank

Silo:

Silo Finance has greatly benefited from Sonic’s exceptional transaction speed and rapid finality. During major market downturns — including the October 2025 crash — Sonic’s high-performance network enabled us to swiftly liquidate millions of dollars in collateral, protecting our lenders and maintaining market solvency. The speed and cost efficiency of Sonic’s transactions are critical for lending protocols like Silo, ensuring we can act instantly to safeguard users and keep markets attractive and stable for lenders.

- Tenzent

Shadow:

During the most recent market crash, Sonic delivered exceptional network performance, maintaining full functionality with the 3rd highest transaction volume across all blockchains while many other networks experienced downtime and congestion. With zero downtime and no transaction failures, Sonic proved its infrastructure is built for real-world volatility, enabling critical DeFi operations like liquidations to process smoothly when users needed them most. We generated $160,000 in trading fees during the event with no issues on the processing.

- 24 dollars

Pyth:

During the October 10 market liquidation, Sonic demonstrated exceptional network resilience — both in terms of transaction throughput and gas cost stability — while Pyth’s on-chain price feeds continued updating seamlessly throughout one of the most volatile periods of the year.

Despite the market stress, the total cost for thousands of on-chain updates amounted to only around 7 S (≈ $2) spent in total gas fees.

To put this in perspective, performing the same update frequency on Ethereum mainnet during that time would have cost around 6.5 ETH (≈$25,000) — over 5,000× more expensive.

What’s even more impressive is that Sonic’s gas fees remained both low and predictable throughout the event. It highlights Sonic’s robustness as an execution layer for high-frequency, mission-critical on-chain services like Pyth’s real-time price feeds.

- Marc T

Xpress:

Xpress was extremely stable even during the most intense moments of the crash, processing over 200 transactions per minute without issue. We were able to process $23,000,000 in transactional volume in 24 hours with $350,000 TVL and zero hiccups.

- Dmitry

Infrastructure and Ecosystem Response

While Sonic’s core network performed flawlessly, supporting infrastructure, such as SonicScan and Rabby’s backends, lagged in indexing and visualization. Ensuring explorers and wallets can match mainnet performance is now a key priority. Plans are underway to offer private stress-testing environments so partners can benchmark and harden their services against future surges.

Third-party services struggled to keep pace. The high-load sequences—those with more than 100 transactions per block—proved particularly challenging for external infrastructures that were not provisioned for peak load. Sonic’s core infrastructure, however, absorbed the traffic seamlessly, demonstrating significant network resilience and throughput efficiency.

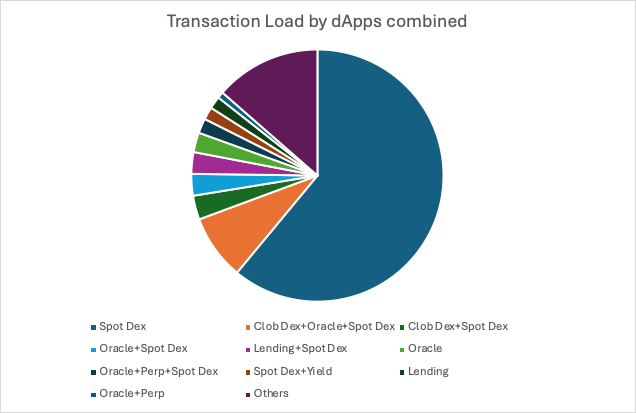

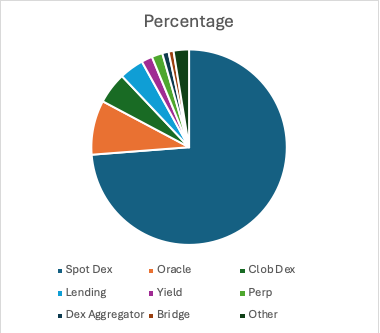

Transaction Classification Insights

We also studied the transaction types in the liquidation event. Of the 2.3 million analyzed transactions (roughly 74% of the total volume), 2.3 million attracted Fee Monetization (FeeM - developers earn up to 90% of transaction fees generated through their apps). Normally, a transaction combines several dApp services. The data revealed that Spot DEX protocols alone accounted for 61% of transaction activity. Combined calls to CLOB DEX, Oracle, and Spot DEX accounted for another 8.34%. The remaining combinations were plentiful but less dominant in the statistics.

When broken down by dApp category in isolation, Spot DEX transactions represented approximately 73.8% of the total, followed by Oracles (9%) and CLOB DEXs (5.1%). These findings align with expectations during liquidation events, where rapid price updates and liquidity adjustments dominate on-chain behavior.

The classification offers a clear window into how Sonic’s ecosystem behaves under pressure and highlights the dominance of real-time trading infrastructure during volatile market phases.

Recap

During October’s market liquidation event, Sonic’s mainnet endured one of its heaviest workloads to date without disruption. Between October 10 and October 13, the network processed more than 3.1 million transactions, peaking at 1,465 transactions per second (TPS) in block 50,113,835. Despite the intensity, Sonic maintained stability.

There were no pending transactions, and the network kept the gas price stable at the minimum cost of 50 GWEI. The performance data from Sonic Mainnet confirms that its architecture can handle extreme stress conditions very well, and it has been built for peak loads.

Looking Ahead

The recent stress test validated Sonic’s performance capabilities and underscored areas where ecosystem tooling can mature. As the team continues to improve throughput, scalability, and developer tooling, Sonic is well-positioned to achieve future scalability milestones.

For transparency, detailed gas price and transaction charts are available on SonicScan:

The event demonstrated not only the technical strength of Sonic’s architecture but also the dedication of the teams across engineering, data, and testing who ensured stability through one of the network’s busiest loads on record.