Staking $S on Sonic: Complete Guide to Rewards, Validators, and Claiming

Staking is a core pillar of the Sonic blockchain ecosystem. By staking $S, holders help secure the network and earn rewards for their participation.

This guide explains how staking works on Sonic, step-by-step guidance on to stake, how to claim and compound rewards, risks, and how staking interacts with Sonic’s broader ecosystem.

What Is $S? Understanding the Native Token

The $S token is the native utility token of the Sonic blockchain, used for:

- Gas

- Network security via staking

- Running and delegating to validators

- Governance participation

Staking $S helps decentralize and secure the network while offering yield to participants.

What Is Staking on Sonic Labs?

Staking on Sonic means delegating your $S to a validator to help run the network and earn rewards based on your stake and their performance.

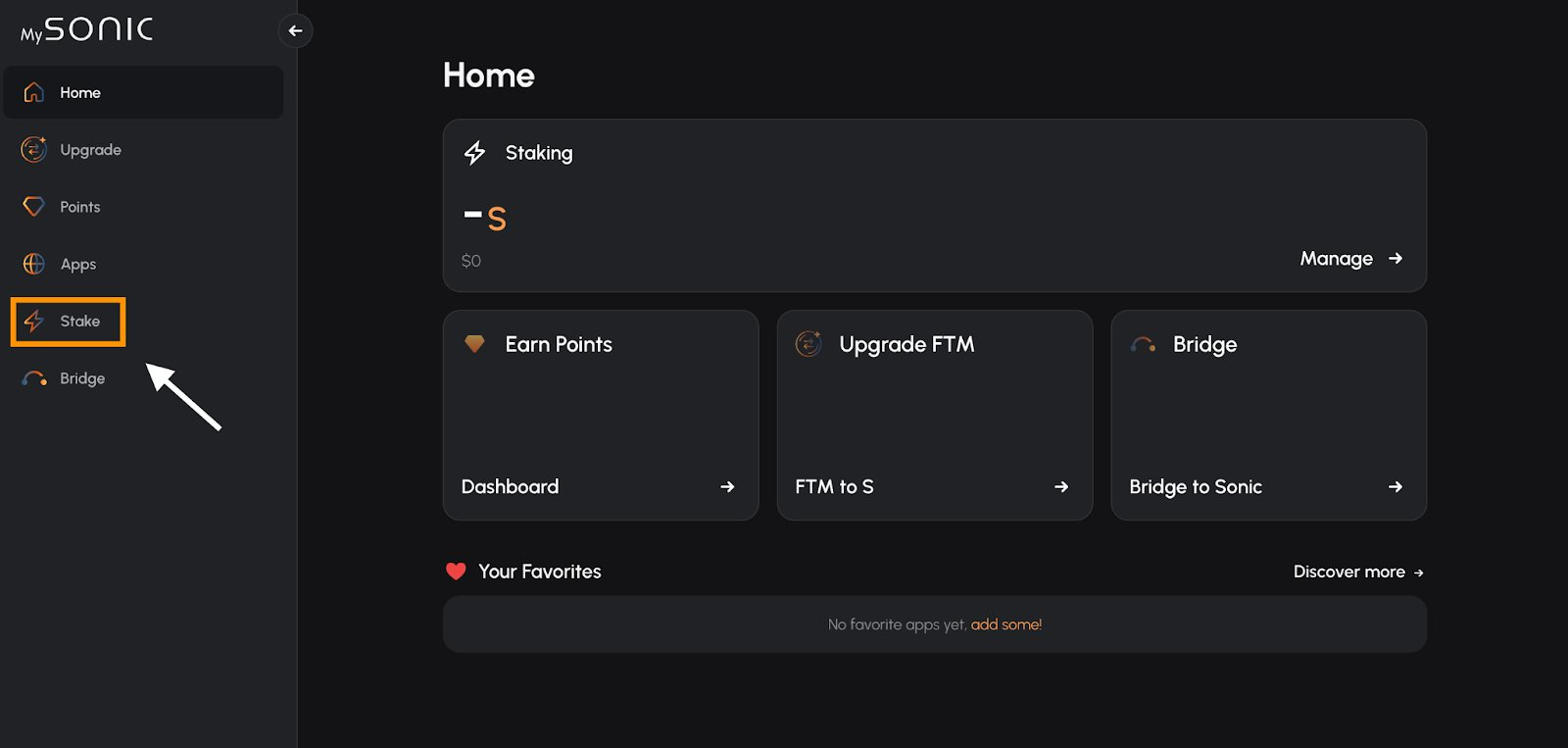

Staking is done through the official MySonic staking portal:

https://my.soniclabs.com/stake

How to Stake $S on Sonic: Step‑by‑Step

Step 1: Visit the Sonic Staking Portal

Go to: https://my.soniclabs.com/stake and connect your Web3 wallet (Rabby, MetaMask, etc).

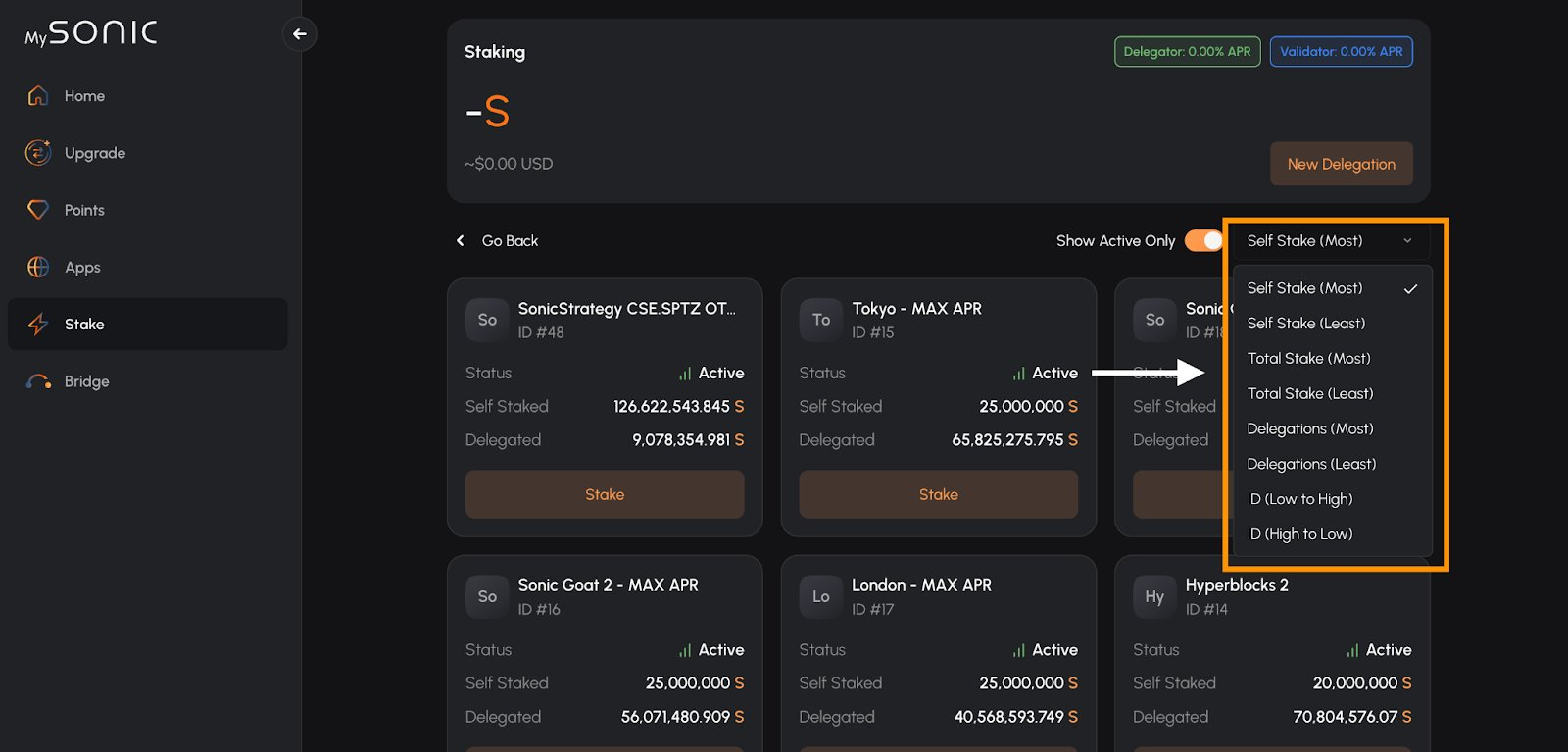

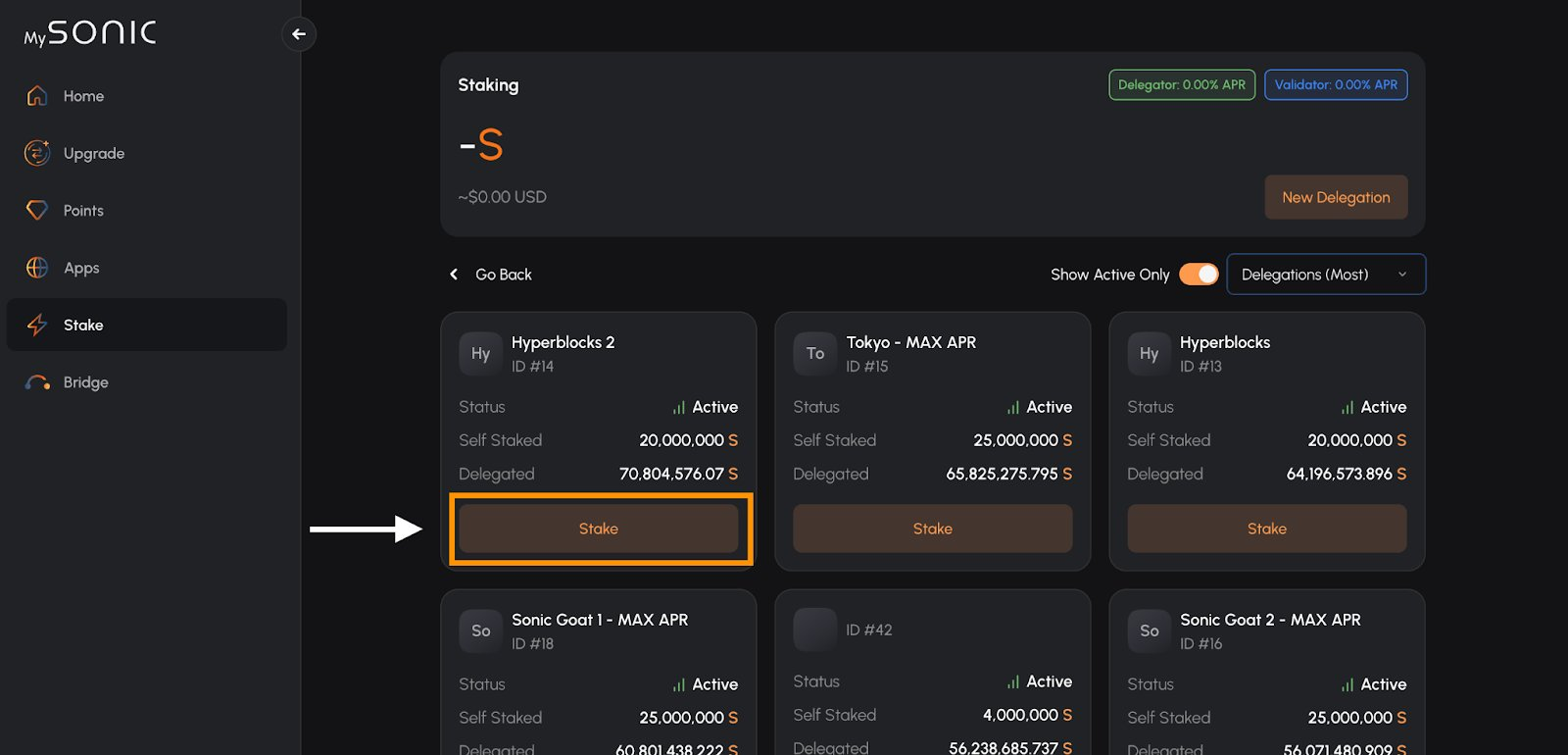

Step 2: Select a Validator

Selecting a strong validator is key to maximizing rewards. Here is what to look out for:

- Uptime & reliability: Better uptime = steady rewards

- Commission rate: Lower fees mean more net rewards

- Reputation: Validators with good community trust reduces risk

- Security history: Avoid validators with penalties or downtime

A reliable validator with a reasonable commission often yields better long‑term returns.

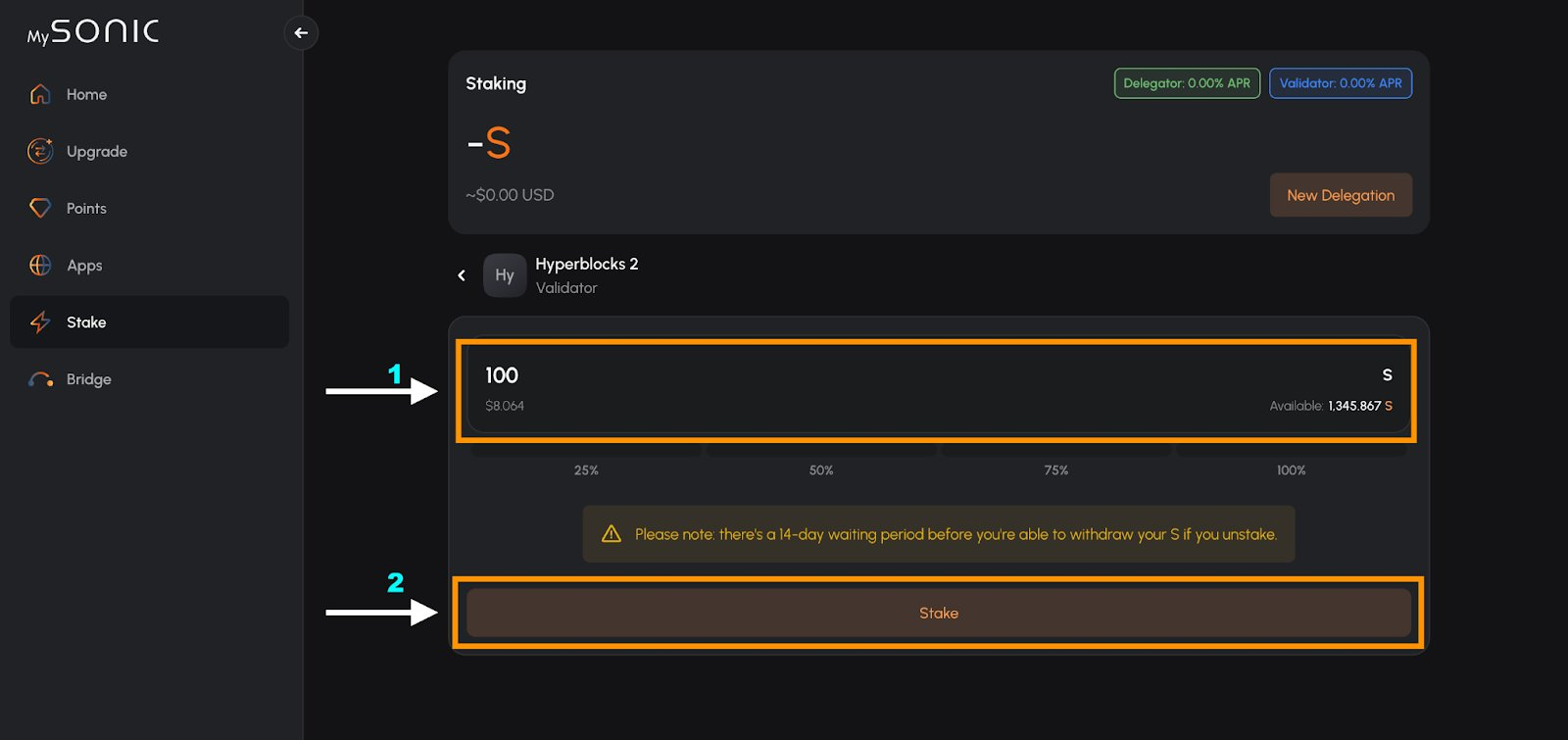

Enter the amount of $S you want to stake and confirm the transaction.

Once delegated, your $S begins securing the network by supporting validator operations and contributing to consensus. In return, you start earning staking rewards based on the amount you’ve delegated and the validator’s performance.

Your tokens remain in your wallet and can be undelegated later, subject to the network’s unbonding rules.

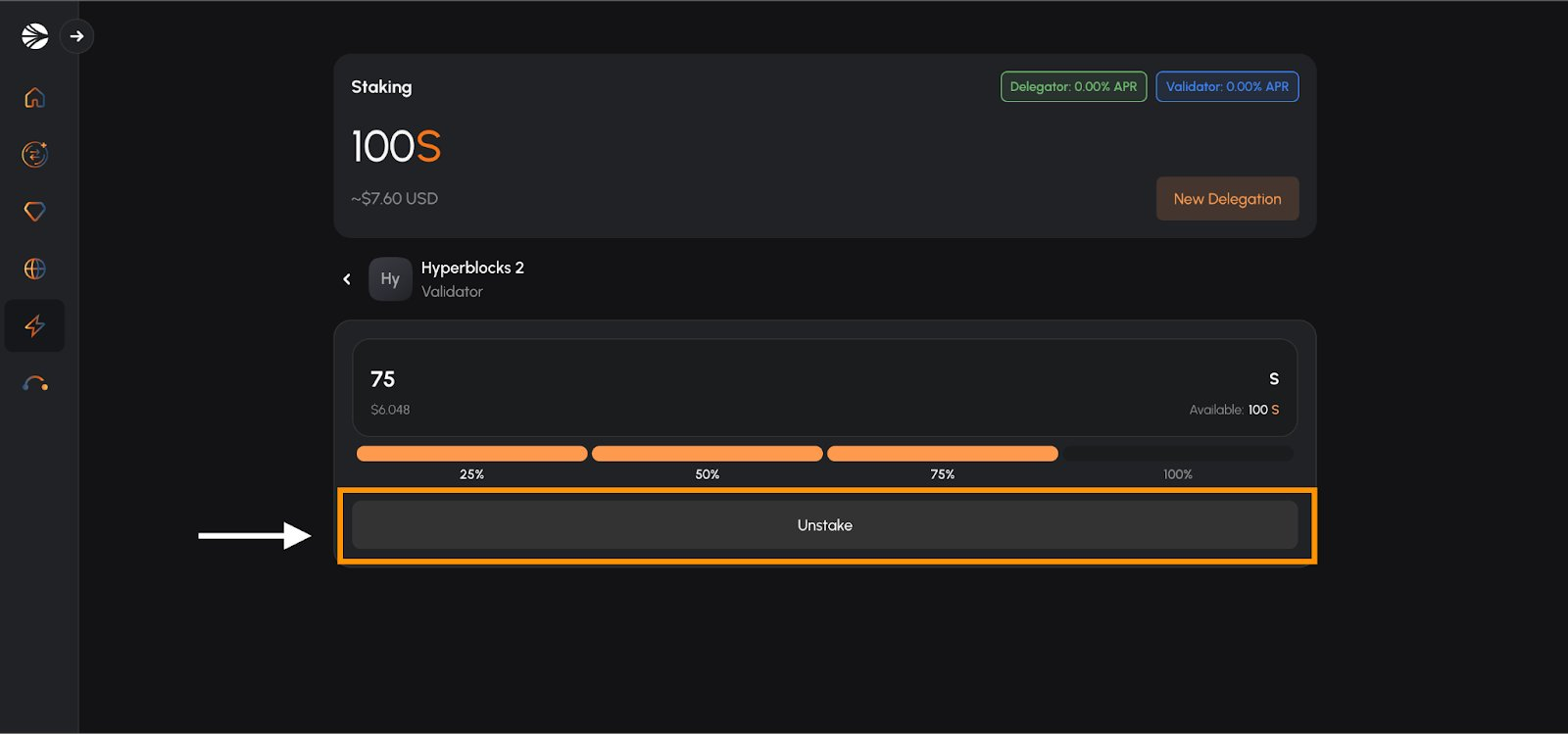

Unbonding Period Explained

When you unstake or withdraw your delegated $S, it enters a 14‑day unbonding period. During this time:

- Your $S is no longer earning rewards

- It cannot be transferred or spent until the period ends

- Only after 14 days can you claim the tokens back

This mechanism enhances network stability and prevents rapid stake withdrawals.

Understanding Staking Rewards

Sonic’s staking rewards are dynamic and influenced by:

- Total $S staked across the network

- Validator performance

- Network block and transaction activity

The protocol aims for a target reward rate. If more tokens are staked, the reward rate adjusts downward; if fewer are staked, it adjusts upward proportionally.

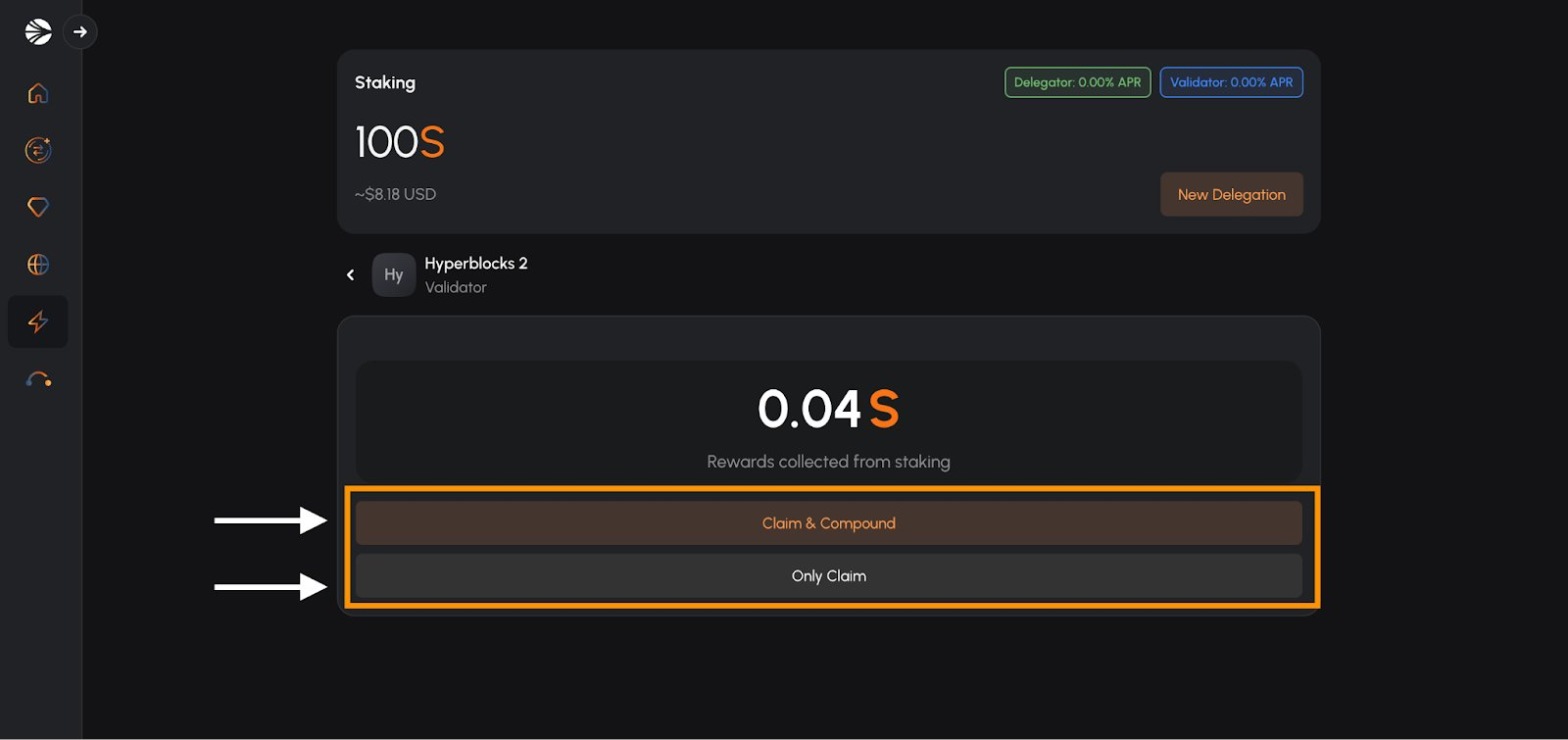

Claiming Staking Rewards on Sonic

Sonic’s native staking rewards DO NOT auto-compound by default. You must manually claim or claim & auto-compound rewards through the MySonic portal.

Claim Rewards: Step-by-Step

- Connect your wallet via https://my.soniclabs.com/stake

- Review your delegation and accumulated rewards

- Click “Claim Rewards”

- Rewards are sent to your wallet as liquid $S

- Staked principal remains unaffected

- No unbonding period is triggered

Claim & Auto-Compound Rewards

- Claim & Auto-Compound is a single action where your earned rewards are claimed and automatically re-staked

- This increases your staked balance and future rewards without needing separate transactions

The main difference is:

- Claim: Rewards go to your wallet, stake remains unchanged

- Claim & Auto-Compound: Rewards are claimed and immediately added to your stake

Native Staking vs Liquid Staking on Sonic

Native Staking

- $S tokens are locked during the 14‑day unbonding period when you decide to withdraw

- Simple and low‑risk, since you stake directly with validators

- No DeFi composability while the tokens are staked. This means that you can’t use them in other protocols

Liquid Staking

- Some Sonic ecosystem protocols offer liquid staking tokens (LSTs) that represent staked $S

- Benefits Include:

- Continued staking rewards while retaining liquidity

- Ability to use LSTs in DeFi (lending, LPs, yield farms, etc)

- No waiting period for liquidity since you can instantly trade or use your LST - Liquid staking introduces additional smart contract risk, although it offers higher capital efficiency compared to traditional native staking

We will cover liquid staking in detail in future guides.

Staking Risks You Should Know

Staking is generally safe, but carries some inherent risks:

- Validator misbehavior: Could reduce rewards or incur penalties

- 14‑day unbonding: Your tokens are illiquid during this period

- Market volatility: The value of $S can fluctuate

- Smart contract risks: All onchain interactions carry code risk

Always stake what you are comfortable holding long‑term and choose reputable validators.

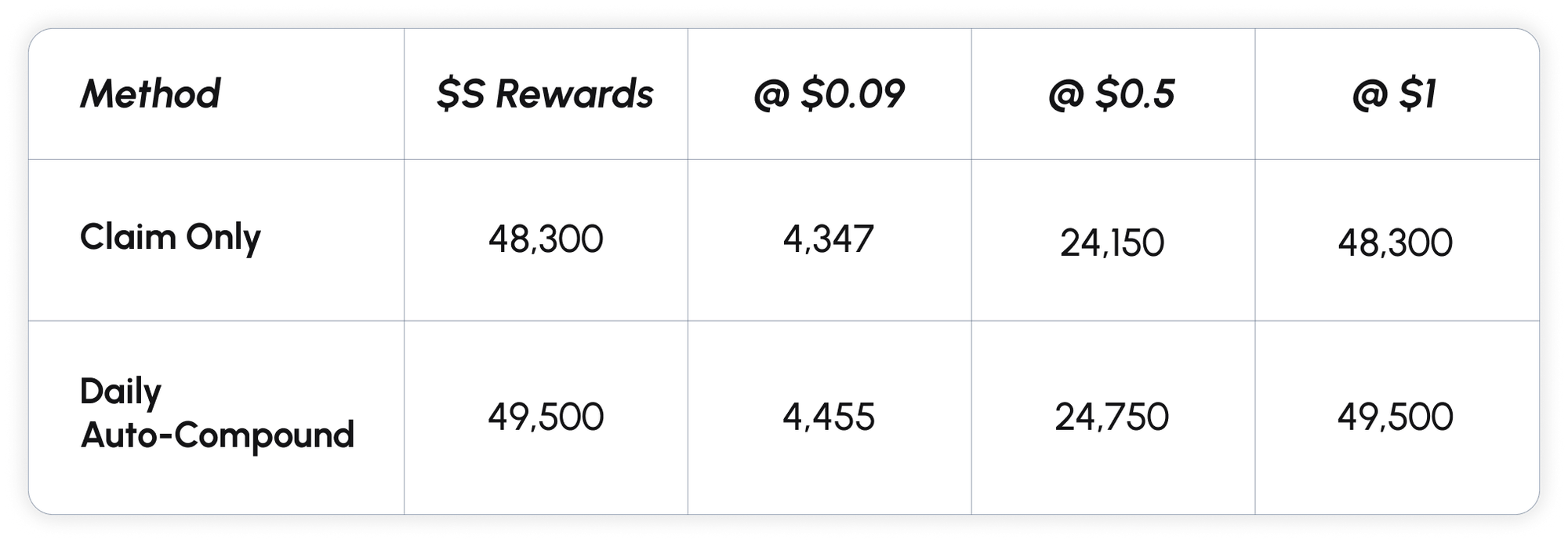

Delegator Rewards Example: 1,000,000 $S Staked

- Delegated $S: 1,000,000

- Current Delegator APR: 4.83%

- Daily auto-compounding: 365 periods/year

1-Year Rewards at Different Prices

3-Year Rewards at Different Prices

Observation:

- Daily auto-compounding gives a small boost over claim-only

- The effect grows over time: ~10,100 $S extra over 3 years

USD difference scales with $S price.

Maximizing Yield With Staking Rewards

Sonic staking rewards can be used to maximize yield beyond simple auto-compounding:

- Borrowing against your rewards to buy more $S and restake

- Participating in LPs, such as S/USDC, using earned rewards

The possibilities are virtually endless. We will explore these advanced strategies in future guides, along with risks involved and best practices.

Why Staking Matters for Sonic

Staking aligns incentives and helps secure the Sonic network. It rewards long‑term holders and participants, encouraging decentralized network maintenance and broader ecosystem growth.

Staking $S is a foundational activity for those committed to the Sonic network. It offers dynamic yield, contributes to network security, and integrates with a broader set of incentives across the ecosystem.